How car insurance renewals work in the UK

Cover types and key terms

UK car insurance is typically third-party only, third-party fire and theft, or

comprehensive. Policies may add courtesy car, breakdown, legal cover, windscreen, and personal

accident. Your schedule shows policy start and end, drivers, class of use, and excesses (compulsory/voluntary).

Renewal timing and no-claims bonus (NCD)

Many policies auto-renew, but price and terms can change. Compare options 2–3 weeks before expiry. Claim-free years

build your NCD; some insurers offer protected NCD, which preserves the discount but not necessarily the price after a claim.

When switching, keep or request proof of NCD to avoid delays.

Compliance and gaps in cover

Driving without insurance is illegal. ANPR and roadside checks identify uninsured vehicles. If a vehicle is off-road,

consider making a SORN and keep it off public roads until insured again. Keep certificate and provider

contacts accessible for incidents or claims.

Mid-term changes

Changing address, mileage, drivers, or vehicle can affect cover and premium. Notify your insurer promptly.

Cancelling early may include fees; check terms and the exact cancellation time to avoid overlap or gaps.

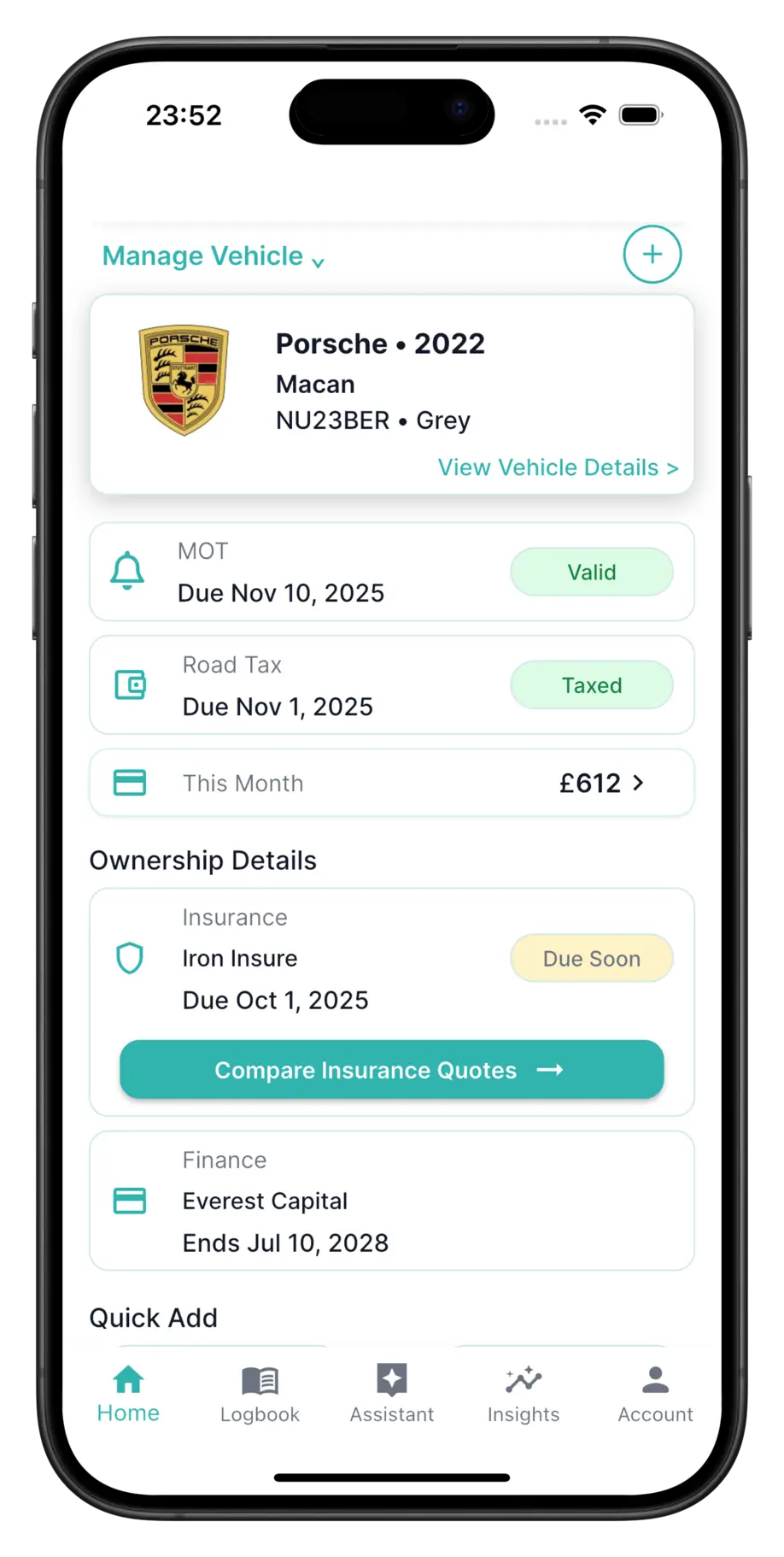

How PitSync helps

Add your plate and set reminders for renewal milestones. Store certificates, note excess, provider, and policy number,

and log payments to see monthly and annual running costs alongside MOT and

vehicle tax. Attach receipts, track changes, and keep a single timeline per vehicle.

Useful checks

Confirm cover and dates using official resources:

GOV.UK — Vehicle insurance and

askMID — Check if a vehicle is insured.

- Early reminders prevent lapses and keep compliance simple.

- Policy locker and notes speed up claims or switches.

- Full cost picture with insurance, MOT, VED, fuel, and servicing.