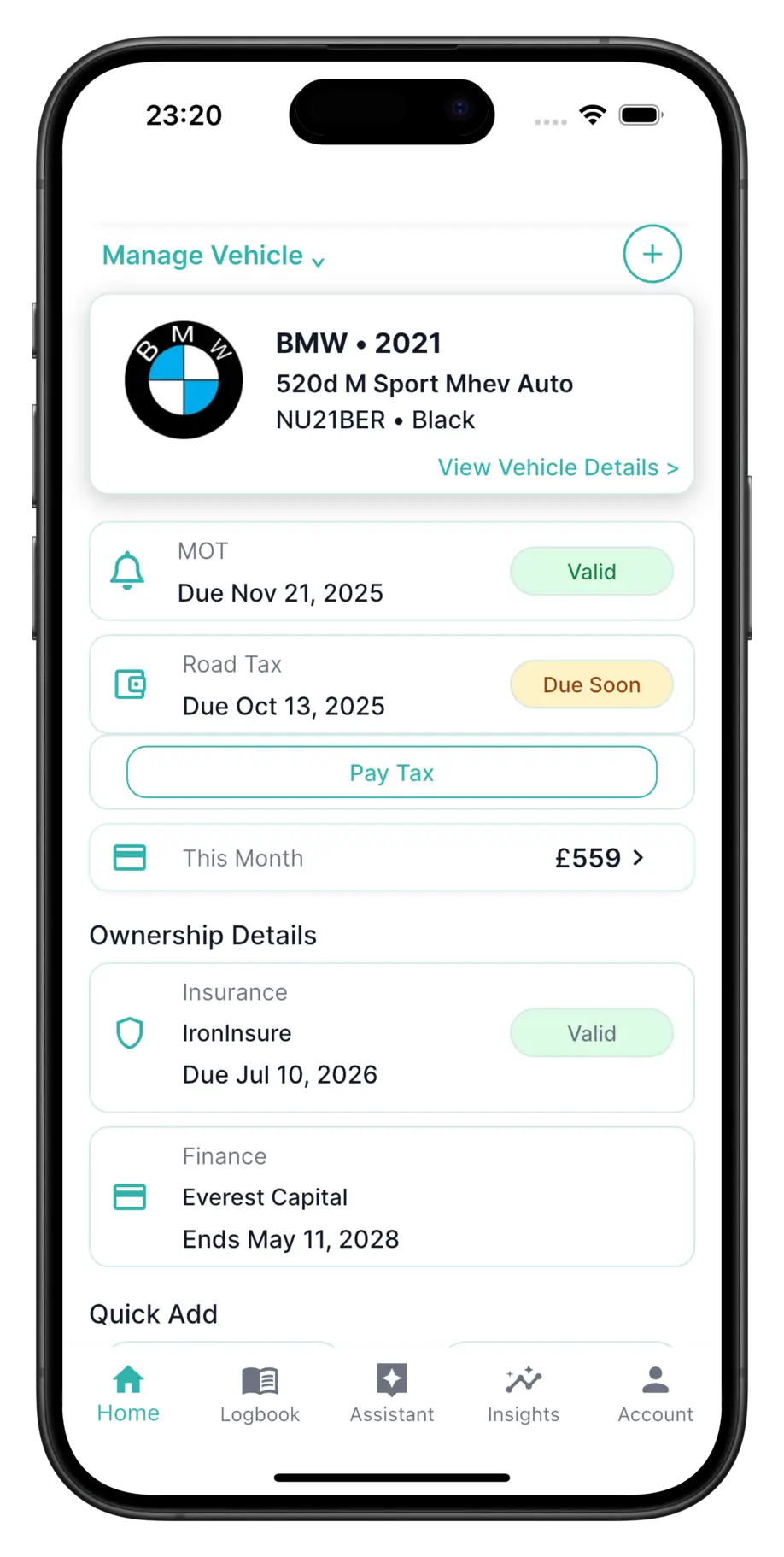

Free Vehicle Tax (VED) Reminder App UK

Set a vehicle tax reminder and receive timely VED & road tax renewal alerts for your number plate. Also track MOT reminders and car expenses in one app.

Why You Need a Vehicle Tax Reminder App

Vehicle tax (VED) must be kept current if your car is used or kept on public roads. PitSync sends early reminders, supports plate-based setup, and helps you avoid lapses or penalties. If you SORN a vehicle, record it and switch reminders off until you tax again.

VED vs Road Tax

Vehicle Excise Duty (VED), commonly called road tax, is the UK tax for using or keeping a vehicle on public roads. Rates depend on fuel type, CO2 band, and registration date, and you must renew on schedule to stay compliant. VED is separate from MOT and insurance, but all three must be valid if the car is on the road. If you keep a vehicle off-road you can make a SORN instead of taxing it. PitSync sends VED & road tax renewal reminders and keeps all dates and proofs in one place.

Automatic VED Alerts

Timely reminders for monthly, 6-month, or annual renewals.

True Cost Tracking

See tax, insurance, MOT, fuel, and service in one view.

Compliance First

Stay on top of VED and MOT to keep driving legal.

AI Assistant

Scan letters or receipts. Log by voice. Fewer admin tasks.